The revolution regarding calls for Congress so you can vote to your crisis services just before election

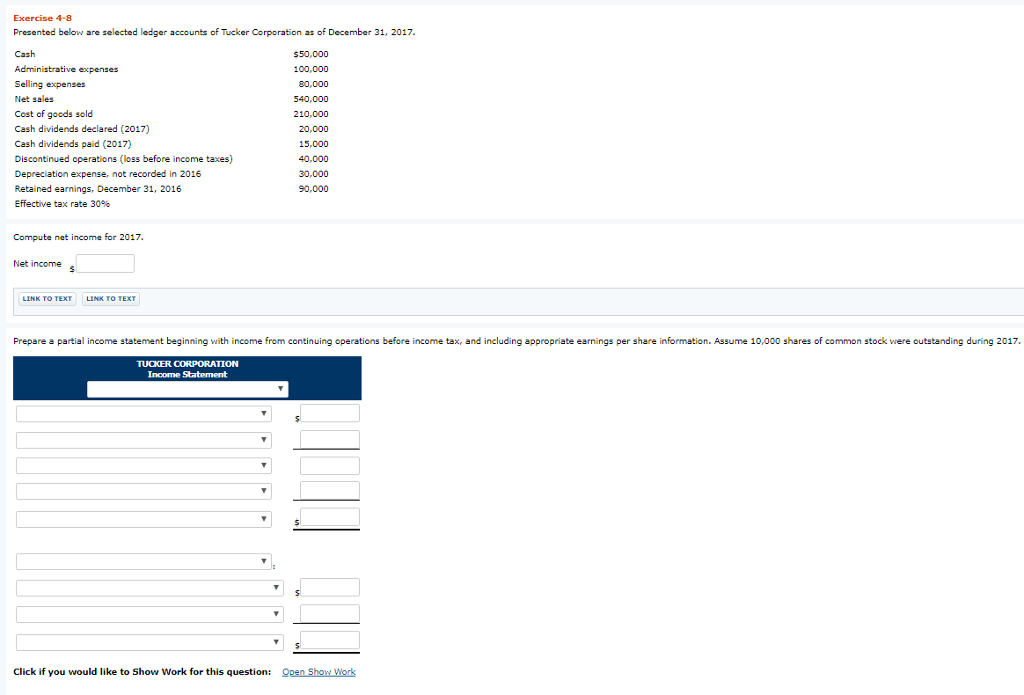

There clearly was a special wave of requires Congress to return to help you Washington to answer this new growing costs off Hurricanes Helene and Milton . Numerous people in Congress out-of hurricane-ravaged claims features issued this new calls for the brand new You.S. Home and you may Senate to respond to the latest destruction of funds from brand new You.

“Its improper you to Congress remains during the recess if you are family members and you can enterprises round the New york and you can beyond are located in immediate demand for direction,” told you Agent. Wally Nickel, a first-title Democrat regarding North carolina.

Nickel said, “From the aftermath off Hurricane Helene, our communities try incapable of recover and our very own smaller businesses was desperate for service because they try to reconstruct. The data recovery work is stalled versus even more investment.”

Congress has returned house from center out of November, as entire You.S. Home and you may almost a 3rd of one’s Senate deal with reelection events. Congressional leaders provides defied calls for action towards loan fund until the election.

The brand new U. Predicated on CBS Reports revealing this past times, the brand new institution got approved cautions to legislators that the hurricanes risked emptying called for loans and you can urged Congress so you can swiftly approve additional money.

The brand new company told you, “Until Congress appropriates even more financing, brand new SBA is actually pausing the brand new mortgage even offers because of its head, low-attention, long-name finance in order to crisis survivors.” The fresh new institution told you it can consistently urge subjects to utilize getting loans “given assurances from Congressional frontrunners that most capital will be presented up on Congress’s go back in the November.”